The growth and success of farmer producer organisations (FPOs) is determined by a crucial element: their financing.

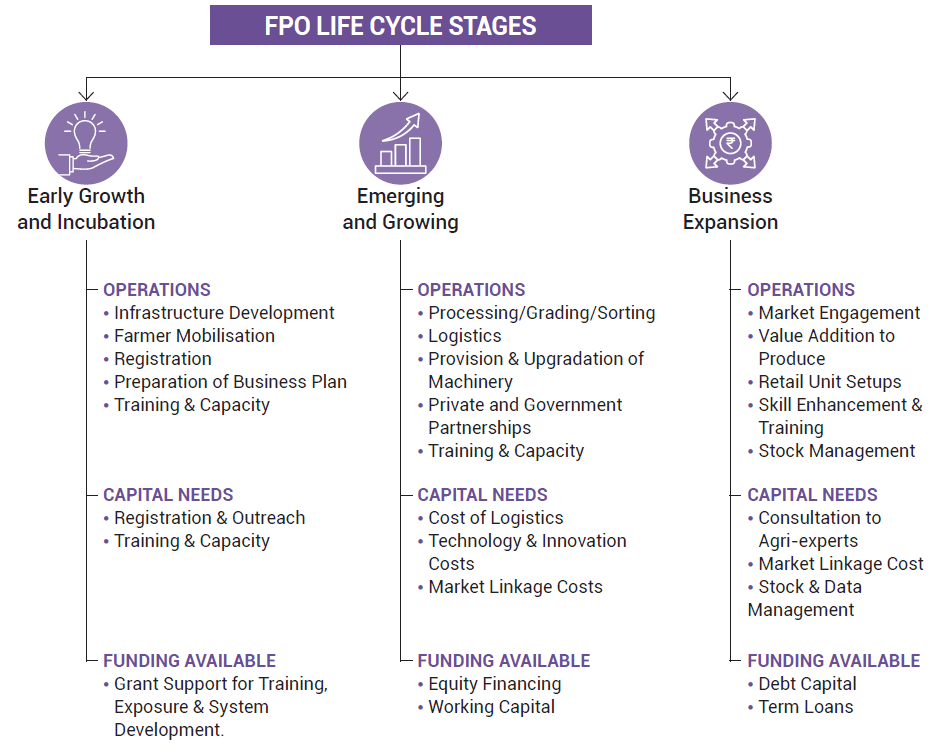

Financing requirements for FPOs vary by the activities across the life cycle, from pre-incubation to incubation, and consolidation stages. As FPOs progress through their life cycle, their financing requirements evolve to support different activities and objectives. Understanding the diverse financial needs and challenges faced by FPOs at each stage is essential for designing effective financing strategies and enabling their full potential.

Grant support is crucial during the pre-incubation stage to establish operations and mobilise farmers. Government agencies and promoting organisations, such as the National Bank for Agriculture and Rural Development (NABARD) through its Producer Organisation Development Fund (PODF), have been instrumental in providing grant and incubation support to FPOs in their early years. Furthermore, several donors including the World Bank, Ford Foundation, Rabo Foundation, and others have played a vital role in supporting capacity development and strengthening the governance of FPOs.

During this stage, FPOs primarily require funds for registration costs, operational expenses, management, and farmer mobilisation to encourage their participation as shareholders in the organisation.

As FPOs enter the emerging and growing stage, they require equity financing and working capital loans. Equity financing in FPOs is typically raised through contributions from shareholder farmers, and it differs from other social enterprises as equity cannot be traded and private equity investments are limited to farmers only. Additionally, FPOs need working capital loans to support their bulk input purchases and crop procurement from farmers once the grant support concludes. Working capital loans can be obtained from NBFCs or formal banks.

During this stage, FPOs are required to have well-developed business plans, maintain accurate data and bookkeeping, and establish balance sheets to qualify for loans.

In the mature stage, FPOs require term loans along with working capital to scale up their operations and expand their businesses. As FPOs focus on quality improvement and value addition, they may need term loans to establish small processing units and infrastructure units that enable innovation in the value chain.

Access to credit from formal banks becomes crucial at this stage, as they offer reasonably competitive interest rates and can provide large ticket-size loans.