Social Impact Bonds as Tool to Finance Public Sector Reform

– By Aashir Sutar, Kisslay Anand, Aditya Kumar and Darshan Kumar

Sattva Consulting, National Institute of Urban Affairs, Sarjan Foundation, and Tata Trusts

Abstract

Social Impact Bonds (SIBs) act as financial assets for attracting investors for funding social programmes by providing incentives if the predefined outcomes and targets of the programmes is achieved by the implementing agency. This paper helps in understanding more about SIBs and their working models with a case study on an education programme implemented in the country to achieve Public Sector Reform.

Introduction

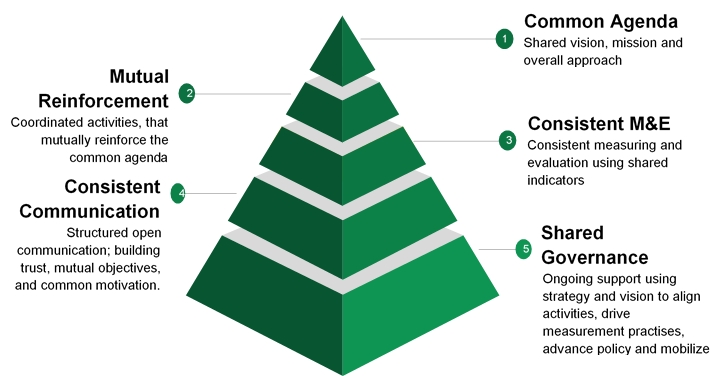

Public Sector Reforms is a programme for financial and management reforms aimed at bringing about long-term productivity improvements in the public sector and better service to the community. The programme is applicable across various sectors like poverty alleviation, healthcare, livelihoods, skill development, and education. Social Impact Bonds have emerged as a new financing tool and has enthusiastically been welcomed as social innovation for funding social impact projects. Social Impact Bonds (SIBs) and Development Impact Bonds (DIBs) can be defined as “Partnership between governments or donors to improve the social outcomes for a specific group of citizens or “beneficiaries” and providing the investors incentives if the project meets its predefined targets.” SIBs represent a financial mechanism aimed to fund interventions relying on an outcome-based contract. They are hybrid instruments with elements of both equity and debt. (Bolton & Savell, 2010; Liebman, 2011)

The idea behind an SIB is that private investors can be attracted to invest in social service interventions that have a positive payoff. SIBs integrate philanthropy, venture capitalism, performance management, and social programme finance into an innovative new mix. It extends and emulates the philosophy and framework of collective impact.

————–

– Aashir Sutar is part of our Consulting Services team and is based in Mumbai.

This is an excerpt of a paper presented at the Biennial Conference on Entrepreneurship at EDII. To read the entire paper, click on the DOWNLOAD link on the left of this page.